Our vision as pioneer of the energy revolution

Since the formation of our Company more than three decades ago, the renewable energy market has seen ongoing change and continuous development. Back in 1990 when the first Electricity Feed-in Act (StrEG) was introduced, renewable energies were still widely regarded as a rather crazy eco-idealist idea. Initially, especially the large power companies, that have meanwhile come to play a major role in renewable energies, were highly critical of these modern technologies.

Today, more than a quarter of a century later, renewable energies have evolved into sophisticated, established and recognised technologies, making a significant contribution to energy production in many industrial nations. In Germany alone, the share of renewable energies already accounts for about a third of the total energy produced; and the higher the share of renewable energies meeting demand, the more sustainable and environmentally friendly the entire energy supply.

New self-perception of the pioneering role

Energiekontor has always had a clear vision for the future: a world where energy needs are covered 100% by renewable energy sources. Our mission statement begins with this vision. It is the key principle underlying Energiekontor’s business activities and the strongest motivating factor for our staff in their endeavours to progress towards this overall target each day by bringing forward creative ideas and taking pleasure in achieving joint success.

Renewable energies will be able to sustainably cover 100% of the energy market once the levelized cost of electricity from renewable energy falls below the cost of generating electricity from fossil and nuclear resources. Energiekontor not only wants to participate in the energy transition but, in order to push forward the breakthrough of renewable energy sources, it also wants to take on a leading role as the pioneer realising one of the first wind or solar parks with a lower levelized cost of energy than conventional energy.

This step will do away with a number of barriers, such as the economic barrier: users will always opt for the cheaper provider as long as this does not entail further disadvantages, above all if the cheaper option is also the more environmentally friendly one. At the same time, a social barrier will fall: renewables are bound to receive stronger backing from politicians and society, especially when wind and solar energy cease to depend on state subsidies. All this will give the renewable energy sector a strong boost.

By taking on a pioneering role in realising wind farms and solar parks at actual market prices, Energiekontor is contributing significantly to promoting the breakthrough to a world where renewable energy sources cover 100% of energy needs. By paving the way, Energiekontor simultaneously gains a competitive edge over other market participants and occupies a strong position within the industry. Having extensively prepared and enhanced efficiency measures for reducing costs along the value chain, Energiekontor gains a crucial competitive advantage. As an innovative forerunner, the Company promotes the ongoing expansion of renewable energy without state subsidies.

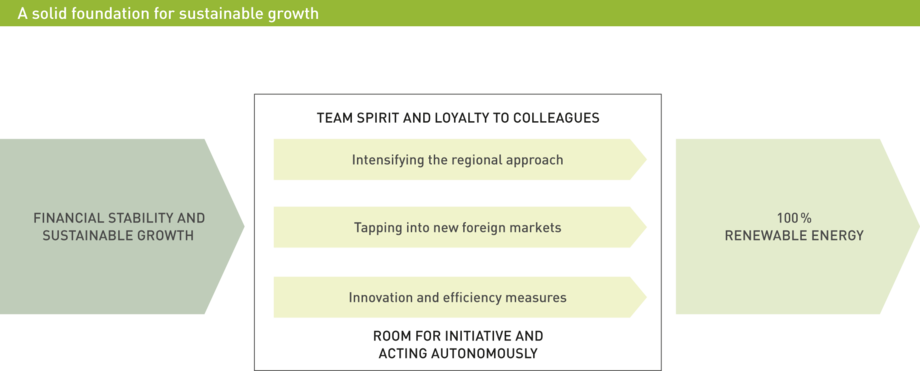

A solid foundation for sustainable growth

The growth model of Energiekontor AG is closely linked to the Company’s mission statement. The Company aims to strengthen its organic growth by intensifying its regional approach and by opening up new markets and by thus actively accelerating the expansion of renewable energy sources despite fiercer competition. The management believes in employee involvement and development and creates the corresponding organisational framework. The basis and foundation of Energiekontor’s growth strategy is its financial stability. This stability is predominately based on the steady flow of surplus cash from Power Generation in Group-owned Wind Farms and from commercial and technical operational management activities.

Intensifying the regional approach

Energiekontor has always emphasised the importance of its regional approach. This allows close collaboration with local authorities and regions as well as a bespoke regional approach with a high level of local acceptance. At the same time, it generates a competitive advantage in each region and accelerates project development. In terms of organisation, the regional approach is implemented by local Energiekontor teams with far-reaching discretionary powers. This principle shall be further intensified by increasing the number of regions, in which Energiekontor is active, both in Germany and abroad.

Tapping into new foreign markets

One major element of the Energiekontor growth strategy is increased internationalisation through gradual expansion of the existing portfolio of countries (Germany, UK, Portugal) in order to develop additional growth potential for the coming years. Simultaneously, the expansion of the solar business is being driven forward, especially in countries with favourable irradiation conditions and the correspondingly low electricity generation costs. At present, Energiekontor is venturing into the following markets:

- France (solar, wind)

- US (solar, wind)

The focus in France and the US will initially be on solar energy. Having acquired sites in these countries, Energiekontor has made good progress in project development, especially in the US. Sites have been secured and own offices opened in both of these countries, where project development will be coordinated and driven forward by newly employed native speakers in designated local companies.

In the course of developing new markets, Energiekontor may decide to extend the selection of countries or, if the Management believes that a more intensive involvement in one or several of these countries is not promising, it may decide to discontinue activities in one or more countries. Energiekontor always applies the same approach. The Company does not enter a market and start the cost-intensive process of setting up project development directly whenever a new national market is added; instead, Energiekontor carries out a systematic review, analysis and selection process to analyse and evaluate the specific conditions for wind and solar projects in the individual countries (legal, political, subsidy systems, grid connection regulations, authorisation etc.). Furthermore, in order to create the structural prerequisites for a possible market entry at an early stage, Energiekontor identifies and, if suitable, takes under contract the first partners for site acquisitions and further market development. The aim of this gradual and inexpensive review process - which can mainly be carried out by existing employees - is to identify the foreign markets that are best suited for the next market entry. Setting up local branches, employing own local staff and local project development will only begin once the final market entry decision has been made. This approach improves the chances of success for developing the market while reducing the risk of misallocating resources.

Innovation and efficiency measures

As a pioneer, Energiekontor wants to actively shape the transition to 100% renewables. It also wants to be one of the first companies to realise wind farms and solar parks at actual market prices in direct competition with the conventional energy sector. This will safeguard the Company’s competitive position in an increasingly market-oriented environment.

For this purpose, Energiekontor has developed various measures over recent years to enhance economic efficiency when planning, building and operating wind farms and solar parks as well as measures to optimise the processes along the entire value chain. Examples include technical innovations, such as rotor blade extension, optimising the supply chain, useful life and financing as well as constant improvements to internal processes and structure. These measures have three objectives:

- to increase the economic viability of projects planned by Energiekontor;

- to increase profits of Groupowned wind farms;

- to accelerate project development solution finding.

These measures play an important role in broadening the decentralised organisation and the project management under the responsibility of employees. This also includes innovative concepts such Scrum, an agile project management methodology.

Room for initiative and organisational decentralisation

Innovation and efficiency are not necessarily restricted to technical innovations. For Energiekontor, widening the decentralised organisational structure also contributes to increasing the Company’s efficiency. Thus, the management deliberately focuses on marked decentralisation of the working and decision-making processes with flat hierarchies in order to avoid unnecessary bureaucracy and to ensure flexibility and fast decisions, even with a growing number of employees. At the same time, the Company creates room for creative and flexible problem-solving approaches and motivates each individual employee to act autonomously.

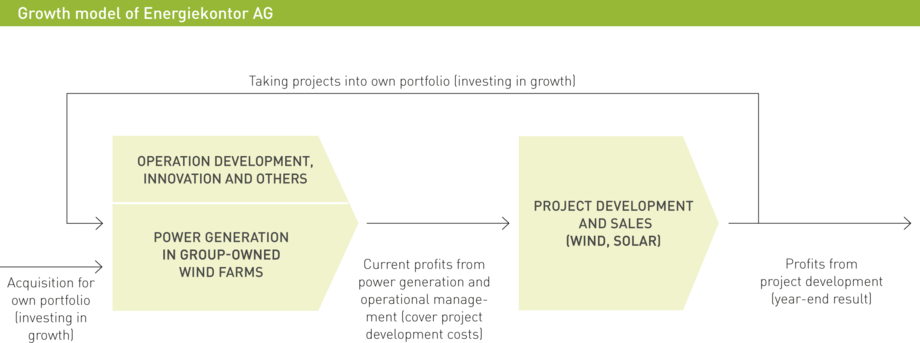

Owner-operated wind farms as a reliable growth driver

Expansion of power generation from Group-owned wind farms is the driving force behind and a central element of the growth model. Steady income is generated by selling the power generated with our own wind farms. Another source of steady income is the provision of management services for completed and operational wind farms by specialised teams from the Energiekontor Group – a service which may be extended to solar parks in the future. This applies not only to the wind farms owned by the Group but also to turnkey facilities that have been sold to energy suppliers, strategic or financial investors. The provision of operational management services to the Company's facility buyers ensures that Energiekontor AG can retain the majority as customers, thus securing regular income from these wind farms well beyond their project completion dates.

Together with the steady income from the operational management of own and third-party farms, the income from selling electricity ensures financial stability and builds the basis for the Company’s sustainable growth. Energiekontor uses the surplus cash thus generated to cover most of the costs of project development including Group-wide personnel and overhead costs. Income from selling in-house developed wind farms and solar parks drives net income and is used to pay taxes and dividends as well as create a liquidity reserve.

Our strategy of expanding power generation in Group-owned wind farms includes

- keeping projects that we have developed and completed in the Group,

- repowering Groupowned facilities, and

- optimising and increasing efficiency.

We intend to transfer around half of the projects that we develop to Group ownership; the other half is designated for sale. The management reserves the right to adjust this ratio depending on the Company’s business situation.

Varying growth dynamics

Company growth varies in the individual segments. In the area of project development, Energiekontor drives growth by increasing site acquisitions and its regional approach as well as by expanding to new markets. In contrast, growth in the Power Generation in Group-owned Wind Farms division is based on transferring projects from project development to Company ownership. The higher the number of wind farms that become Group-owned wind farms, the more cash can be generated from the sale of electricity and operational management, and the more funds are available for project development in order to promote growth. In conclusion, growth is mainly accomplished by expanding the Group-owned farm portfolio as well as increasing the surplus cash gained from operating Group-owned wind farms and from operational management. The accompanying innovation and efficiency measures that lead to further rises in profits and that further increase the surplus cash from power generation in Group-owned wind farms intensify this organic growth process.

One positive side effect of this growth strategy is the fact that it reduces dependency on project selling and proceeds from project sales. The Group’s liquidity and project development financing (including the Group-wide personnel and overhead costs) is covered by the surplus cash generated from power generation in Group-owned wind farms and operational management even if no income is generated from project sales. Financial risk is thus minimised to the greatest possible extent. The Energiekontor growth model thus differs from many competitors’ business models in the industry that do not have a comparable portfolio of Group-owned wind farms.

In the more than 25 years since the formation of our Company, the renewable energy market has undergone ongoing change and continuous development. Back in 1990 when the first Electricity Feed-in Act (StrEG) was introduced, renewable energies were still widely regarded as a rather crazy eco-idealist idea. Especially the large power companies that now play a major role in renewable energies were initially highly critical of these modern technologies. Today, more than a quarter of a century later, renewable energies have evolved into sophisticated, established and recognised technologies, making significant contribution to energy production in many industrial nations. In Germany alone, the share of renewable energies already accounted for about a third of the total energy produced in 2016. The higher the share of renewable energies in meeting demand, the more sustainable and environmentally friendly the entire energy supply.

Business objectives

Energiekontor plans to use this strategy to increase project development EBT in a stable and sustainable manner to around EUR 30 million per year in the medium term. This figure already accounts for the elimination of profit from the construction of wind farms intended for Group ownership arising from Group consolidation; it is therefore not recognised in Group profit.

The intention behind expanding the portfolio of Group-owned wind farms is to establish Energiekontor as a medium-sized producer of renewable energy while effectively minimising dependency on general developments in the market. With the income from additional Group-owned wind farms and operation development, the company intends to sustainably generate EBT of EUR 25-30 million p.a.

The expansion of the Group-owned wind farm portfolio will be sourced from the company's own projects, the repowering of existing portfolio assets and, where appropriate, the acquisition of third-party facilities. The company will finance this new tranche of capital spending with project financing loans, project-related bonds, equity capital and regular surplus cash from existing portfolio wind farm operations.

Energiekontor has spent the last few years creating an environment that favours a stable and sustainable growth trajectory, and is extremely well placed to face the challenges of the future in a highly competitive market.